Table of Contents

Introduction

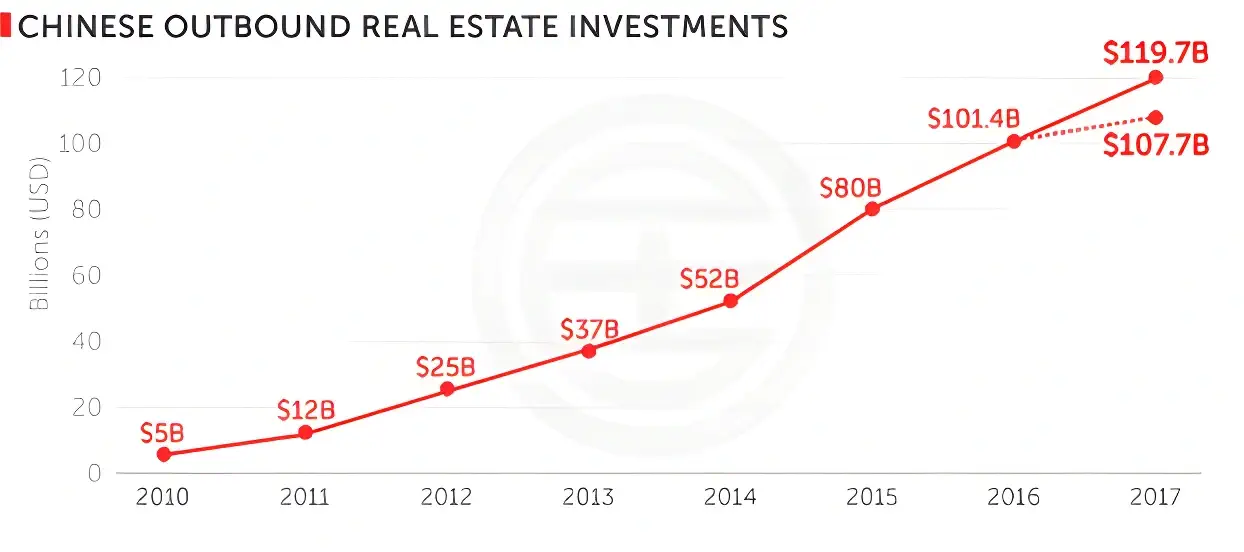

The Chinese real estate market is getting smaller as we move towards 2025.

The value of new residences sold has dropped by more than 23% through August 2024, from around 30% of China’s GDP. In fact, China’s biggest cities, like Shanghai, Shenzhen, Guangzhou, and Beijing, have had to put in place new policies to keep things stable.

Dubai’s real estate market, on the other hand, seems to be getting stronger and stronger.

Where are Chinese people buying property in Dubai in 2025 and beyond?

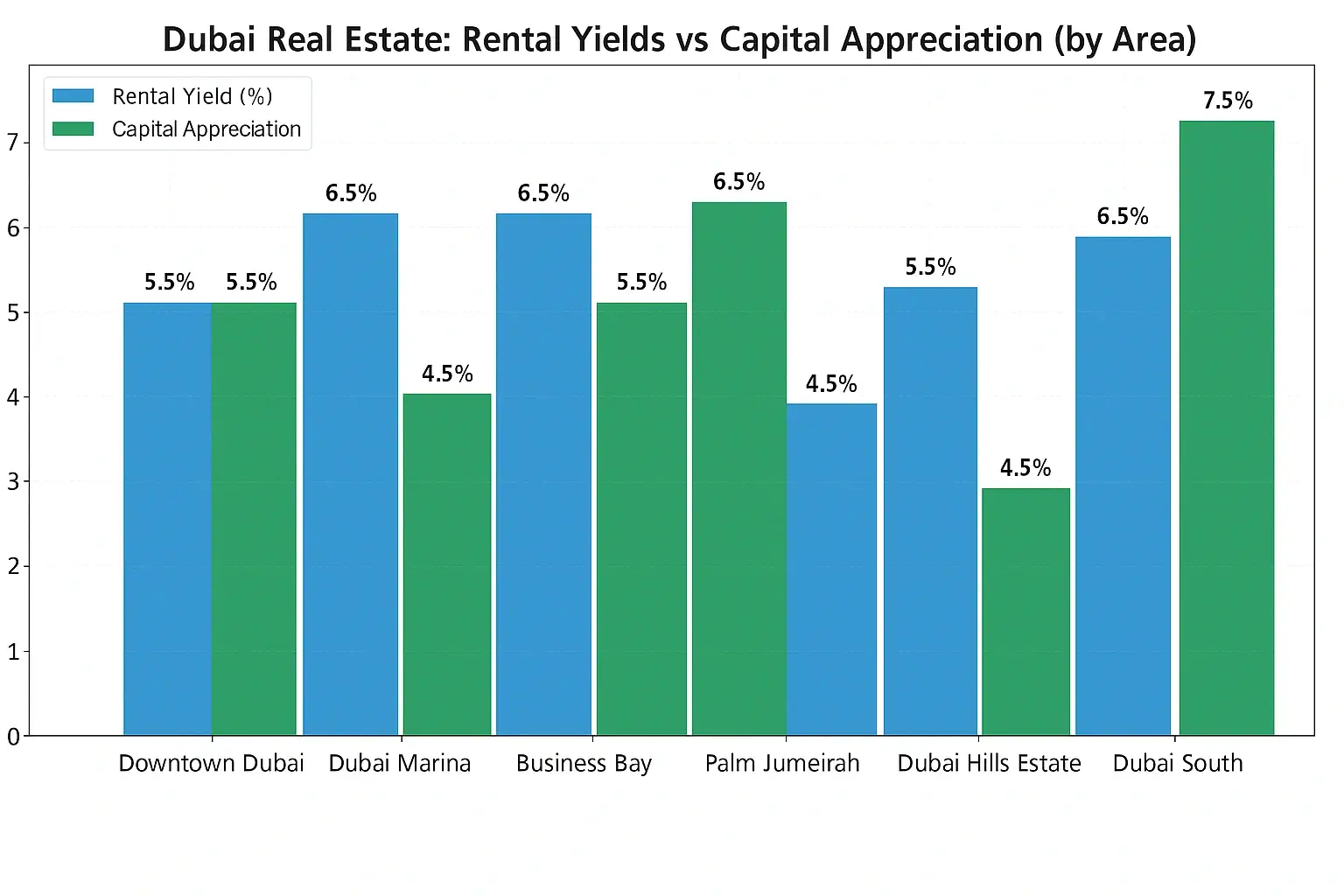

- High-end apartments, luxury hotels, and business spaces may be found in Downtown Dubai, which is located in the center of Dubai and is surrounded by the world-famous Burj Khalifa. Burj Khalifa, Dubai Mall, and Dubai Opera are some of the most important landmarks in Dubai. Rental yields in this region typically between 5 and 6 percent, and annual capital appreciation is also between 5 and 6 %

- Luxury apartments, penthouses, and waterfront villas can be found in Dubai Marina, which is located next to Jumeirah Beach Residence and is situated along the shores of the Persian Gulf. Dubai Marina Mall and The Walk at JBR are two of the major landmarks in the city. The annual capital appreciation is between 4 and 5 percent, while the typical rental yield is between 6 and 7%

- High-rise apartments, business spaces, and mixed-use complexes can be found in Business Bay, which is situated in a central location near to Downtown Dubai. A number of important landmarks include the JW Marriott Marquis Hotel and the Dubai Canal. Business Bay is a key player in the market, owning a market share of approximately 9%, and benefits from annual capital appreciation of between 5 and 6 percent and average rental yields of between 6 and 7 %

- Dubai Creek Harbour is a mixed-use development that features high-rise residences, waterfront villas, and mixed-use complexes. It is situated along the Dubai Creek, close to the Ras Al Khor Wildlife Sanctuary. Creek Marina and Dubai Creek Tower, which will be the world’s tallest building in the future, are both notable landmarks. With yearly capital appreciation of roughly 6-7% and average rental yields of approximately 5-6%, this region is gaining popularity as a real estate investment destination. A market share of approximately 8% is held by it.

- Palm Jumeirah is a man-made island that extends into the Persian Gulf and features hotels, beachfront condominiums, and hotel rooms that are of the highest quality. Atlantis The Palm and Nakheel Mall are two of the most notable landmarks in the area. Palm Jumeirah offers yearly capital appreciation of between 4 and 5 percent and typical rental yields of between 5 and 6 %

- Villas, townhouses, and flats are all available for purchase in Dubai Hills Estate, which is located in a location that is centrally located between Downtown Dubai and Dubai Marina. The Dubai Hills Mall and the Dubai Hills Golf Club are two of the most notable sites in Dubai. This region has a market share of roughly 6%, the typical rental yields are between 5 and 6 percent, and the annual capital appreciation is between 5 and 6 %

- Affordable flats, townhouses, and villas may be found in Dubai South, which is located close to Al Maktoum International Airport and the location of Expo 2020. Both the location of Expo 2020 and Al Maktoum International Airport are considered to be significant landmarks. Rental yields in this region are typically between 6 and 7 percent, while yearly capital appreciation is between 7 and 8 %

The Role of China Investors in Dubai’s Real Estate Growth

Building Stronger Ties Between Two Countries

The UAE has made strategic moves like the Belt and Road Initiative and alliances with China that have made it easier for Chinese investors to get involved in the UAE’s real estate sector. The UAE’s attractiveness to Chinese investors is much stronger because of the free trade deal with China and tax reductions for Chinese enterprises. These projects have not only brought in money, but they have also made the relationship between China and the UAE stronger.

Chinese Money Going into Dubai Real Estate

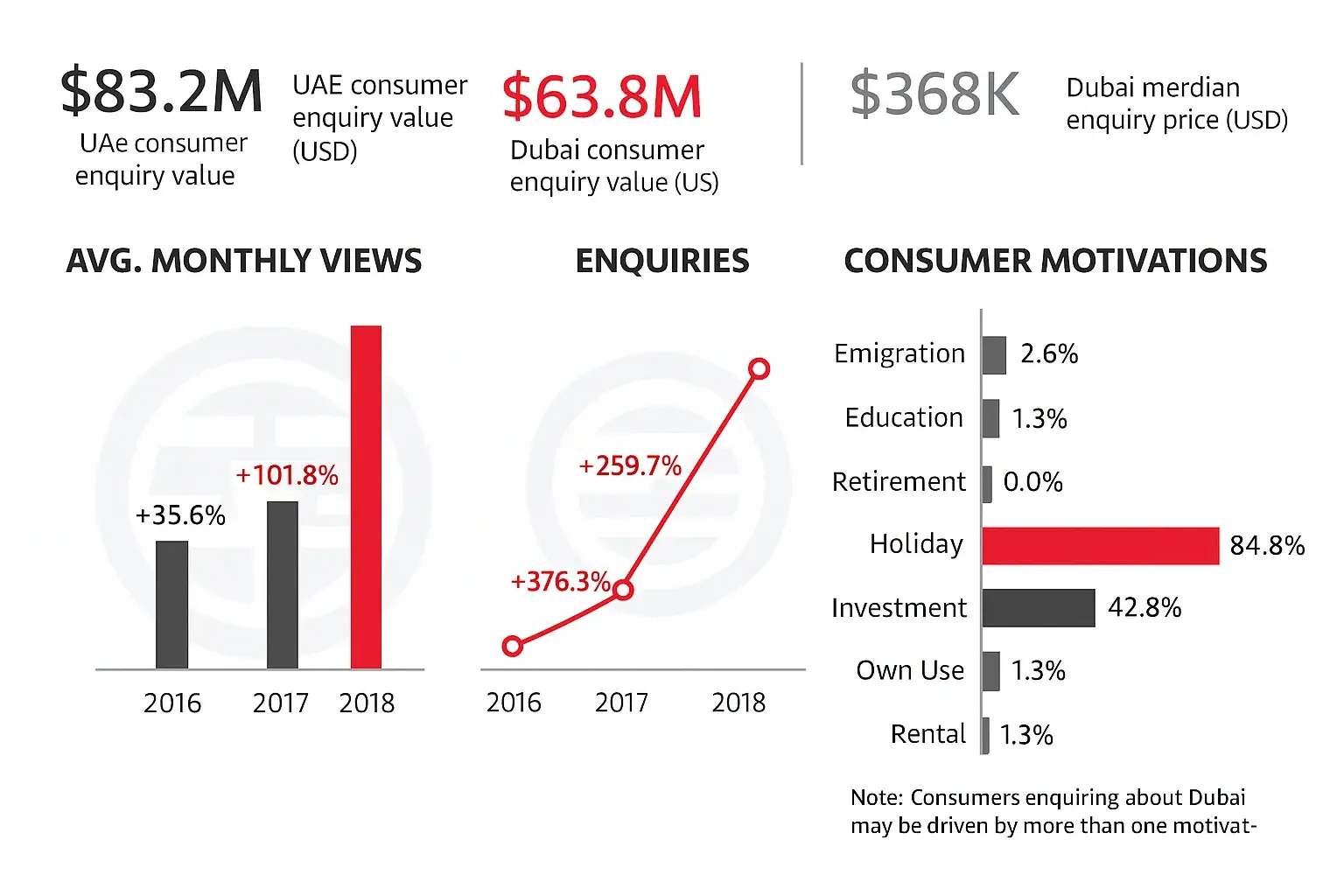

Chinese investors have been putting more and more money into Dubai’s real estate market since there are so many good deals to be had. Chinese investment has been rising quickly, as shown by Emaar developments, where Chinese purchasers have increased the amount of money they put into real estate. With a 30% share of all house purchases before construction, Emaar has become a popular alternative for Chinese investors.

The Belt and Road Project

The Belt and Road Initiative (BRI), which is President Xi Jinping’s plan to make China more dependent on the rest of the world, is very important for understanding Chinese policies and how they affect the Dubai real estate market. The BRI’s goal is to improve communication and collaboration between China and the nations along its projected routes. It does this by funding infrastructure projects that help the economy grow. Chinese investments in the Dubai real estate market are one example of how this project is expanding China’s economic presence around the world.

What this means for the Dubai real estate market

There are both good and bad effects of the large amount of Chinese money coming into the Dubai real estate market. On the plus side, Chinese investors bring in money that the market needs and help it thrive. Their investments can improve Dubai’s economy as a whole and create jobs in the real estate sector. Also, stronger ties between China and the UAE can lead to more economic cooperation and trade prospects.

There are also worries about how much the Dubai real estate industry relies on Chinese investors. A lot of money coming from one country might make things more risky and open to attack, especially if the money suddenly stops coming in. If Chinese buyers modify the way they invest, the market could become too dependent on them, which could cause problems.

A look at the real estate markets in Dubai and Beijing

Comparing the Dubai real estate market to the Beijing real estate market is necessary to get a better idea of why Chinese investors are interested in Dubai real estate. There are several things that affect investing decisions in each market. We can figure out exactly why Chinese investors are interested in Dubai by looking at the differences and similarities between the two markets.

The Dubai real estate market

People realise that the Dubai real estate market grows quickly and offers good investment prospects. Global investors love this city because it is in a good spot, has a business-friendly atmosphere, and has modern infrastructure. Chinese investors are especially interested in Dubai because the city has strong ties to China, there are Chinese populations there, and there are agents and businesses that speak Chinese.

The chance of getting a good return on investment is one of the main things that draws Chinese investors to the Dubai real estate market. The market has been growing steadily over the years, and home values have reached all-time highs. Dubai also has a wide choice of properties, from high-end villas to cheap apartments, so there is something for every investment budget.

Key benefits of investing in Dubai for Chinese investors

- Dubai is a major place where Chinese investors look for good business prospects.

- The main reasons for this development include economic benefits, good policies, and the region’s strategic location, which makes it easy for international investors to get into new markets and make money.

- Dubai’s investor-friendly visa policies have greatly increased investor confidence in its booming real estate industry. The government wants to promote foreign investment, so it offers long-term resident permits to people who buy property worth 5 million dirhams or more. It also offers retirement visas with no age limit.

- There are a lot of good prospects and chances in both residential and commercial properties in the UAE’s real estate market for Chinese investors who want to invest outside of China. The ongoing infrastructure developments, like ambitions to connect global economic corridors, make it an even better choice for real estate investment.

What will happen with Chinese investment in Dubai real estate in the future?

There are more Chinese investors in Dubai, which is beneficial for the market, especially as Expo 2020 gets closer. In 2018, Emaar also said it would create the biggest Chinese neighborhood in the Middle East. This was revealed at the same time as Chinese President Xi Jinping’s historic visit to the UAE. Lee and Black both said that Chinese investors were very interested in this proposal. After announcing investments in Emaar’s zone in Chinatown, Black reported that several investors came to Huaxia Real Estate.

Dubai was now looking for Chinese real estate investments of AED 1 billion in 2019. This program not only encourages Chinese property developers to invest in Dubai, but it also gives many UAE developers the chance to grow their businesses in China. China’s investment in Dubai’s real estate market is likely to lead to a rise in the city’s economy, given all the great events that are happening. Lee and Black both look forward to 2019 and promise to give investors in China and other nations the best investment support possible.

FAQs

Foreigners can easily buy property in Dubai because the laws are clear, there are many off-plan and ready choices, and the people who own the property have clear ownership rights. They can also use the property as a second home or rent it out to make money.

Yes, Chinese investors can get residency visas for 5 or 10 years if they buy land worth a certain amount. This makes investing in Dubai from China even more appealing.

No, foreigners, including Chinese investors, can fully own homes in certain “freehold” places. This means they have full control over the property.

Dubai is a popular place for Chinese investors looking for solid returns because it is tax-free, has high rental yields, is in a good location, and offers a high-class way of life.

Join The Discussion