Table of Contents

It would be impossible to miss Dubai’s skyline, which has futuristic building, affluent waterfront living, and one of the real estate markets that is expanding at the quickest rate in the world. What could possibly be more fascinating? In order to purchase a home or investment property in Dubai, you do not need to be physically present in the city or even visit it.

It is now much simpler than ever before to purchase real estate in Dubai from a remote location, particularly for non-residents, as a result of developments in technology, rules that are favorable to property ownership, and a robust legal system.

Within the confines of this blog, we will walk you through the process of purchasing a property in Dubai as a non-resident, without you having to physically enter the United Arab Emirates.

If you’re wondering how to invest as a foreigner in Dubai real estate, you’re not alone. Thousands of buyers are doing it fully online from abroad.

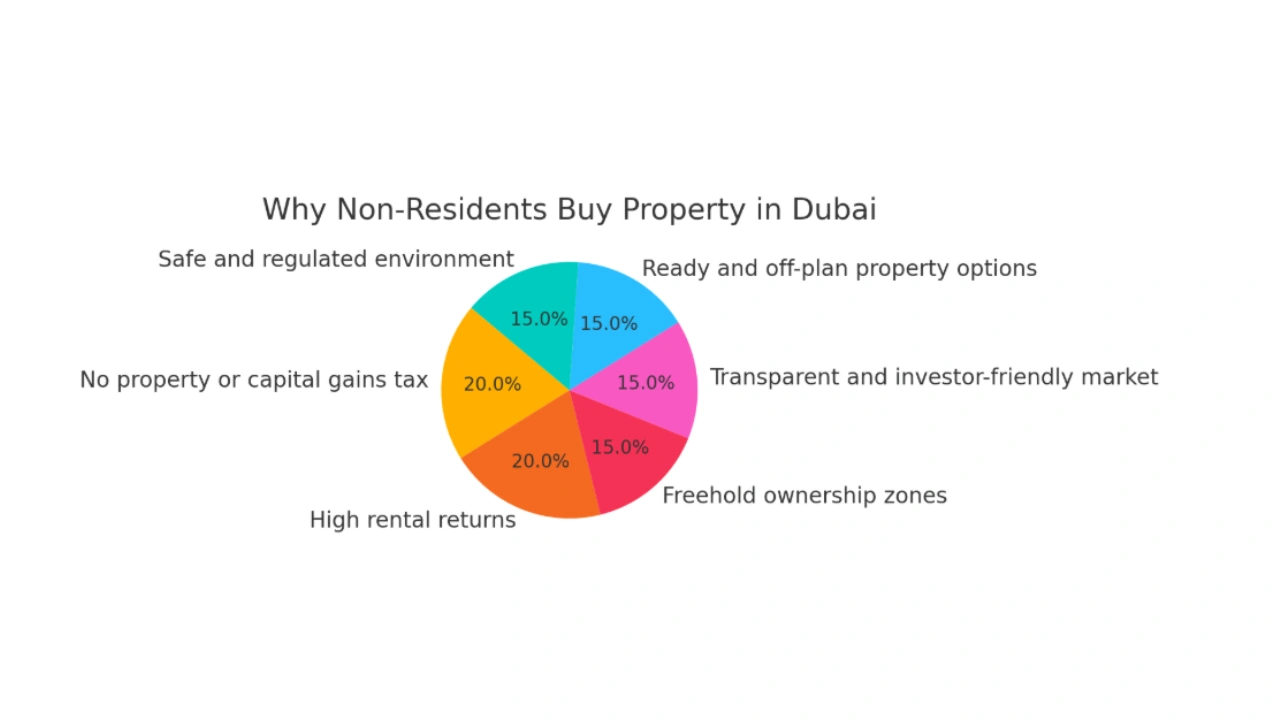

Why is Dubai attracting a large number of buyers from beyond the country?

Before continuing with the procedure, it is essential to have a solid understanding of the reasons why non-residents are selecting Dubai:

- Neither a tax on property nor a tax on capital gains

- High rental returns in comparison to those of other cities throughout the world

- Unrestricted foreign ownership in areas that have been become freehold

- A marketplace that is open to investors and transparent

- Opportunities available in ready-made and off-plan properties

- Environment that is both safe and regulated

One of the biggest draws for global investors is that there’s no non-residence property tax, which keeps holding costs low and returns high.

Step-by-Step Guide: how to invest as an foreigner in Dubai Real Estate without visiting city

1. Acquire an Understanding of Requirements for Non-Residents

It is possible for non-residents and foreign nationals to purchase real estate in Dubai’s freehold neighborhoods, including Downtown, JVC, Dubai Marina, Business Bay, and other such neighborhoods. In order to start the process, you do not need to have a resident in the UAE or even a visit visa.

Tip: Always make sure that the project has been approved by the developer and that it is located in a zone that is defined as freehold.

2. Consult with a Real Estate Agent or Developer Who You Can Rely On

When you are making purchases from a distance, your local partner in Dubai is of the utmost importance. Choose a real estate company that is registered, and preferably one that is DLD-certified. Not only do reputable agents counsel you, but they also assist in determining whether or not the property is legitimate.

Make a request for:

- Live video walkthroughs or virtual tours are available.

- A trusted agent will help you avoid complications related to non-residence property tax or unverified listings.

- Planograms and brochures that have been updated

- Comparison of the market and study of the area

- Historical context and track record of the developer

3. Choose the Property and Obtain Certain Legal Particulars

After you have selected a property, your real estate agent will offer you with:

- A form for reservations

- Agreement to Sell or Memorandum of Understanding (MoU), respectively

- Specifics of the property, including its location, amenities, and developer license, among other things

It is possible to carry out all of these tasks digitally, and you can even ask a lawyer to examine them.

4. Put something down as a deposit

Making your initial contribution, which is typically between 10 and 20 percent, through an international bank transfer is the next stage. As a result of the fact that Dubai developers and agents are accustomed to working with clients from other countries, this aspect is simplified.

Make sure that:

- The payment is made to both the escrow account and the developer.

- A receipt or a confirmation of payment is provided to you.

- For the purpose of safeguarding your investment, Dubai employs escrow accounts. Prior to the completion of specific building milestones, your money will remain secure.

5. Put your digital signature on the sales agreement

The final Sales and Purchase Agreement (SPA) will be sent to you for electronic signature by either your agent or your attorney. It is possible that you will be required to:

- Notarize your signature in the area, and then send it via courier.

- Another option is to provide your attorney or agent in Dubai with a Power of Attorney (PoA).

The ability to sign and register documents on your behalf is granted to your local representative as a result of this.

6. Get the property registered with the DLD and get an NOC

Following the signing of the SPA and the completion of the payment:

Your agent must submit an application to the developer in order to obtain a No Objection Certificate (NOC). The property is then registered in your name with the Dubai Land Department (DLD) after an initial registration. It is possible to send any and all documents, including the title deed, either digitally or via courier.

When you put money into real estate from a distance, you not only make things easier for yourself, but you also open up more options throughout the world. If you live in Europe, Asia, or North America, buying property in Dubai can protect you against inflation and provide variety to your portfolio. You may save money on travel and administrative costs while nevertheless benefiting from one of the most active property markets in the world because you don’t have to be there in person.

Are you able to have faith in the process of purchasing items remotely? In that case, here's why:

As a result of its policies that are advantageous to investors, its futuristic infrastructure, and its tax-free environment, Dubai has become a global powerhouse in the real estate business. The city is also recognized for finishing projects quickly and building things well, which makes it a good place for investors from all over the world who want luxury and long-term value. There are other initiatives undertaken by the authorities, including the Golden Visa and 100% foreign ownership, and this contribute to the city’s expanding popularity.

All transactions involving real estate are subject to regulation and oversight by the Dubai Land Department (DLD).

- In order to register their projects with RERA, developers are required to obtain a license.

- Investors’ funds are safeguarded by escrow accounts.

- The power of attorney is legally binding and subject to oversight.

- The documentation of all agreements and payments is done through ways that can be traced.

Thousands of investors from all over the world, including those from India, the United Kingdom, Europe, and other regions, are now purchasing real estate in Dubai from their home country or even while they are traveling.

Need a More information About It?

Our agents will help you explore premium options tailored to your lifestyle, location preferences, and investment goals.

Off-Plan Properties versus Ready Units: Which Is Better If You Are a Buyer from a Remote Location?

The Advantages of Off-Plan

- More affordable rates and a variety of payment options

- Upon completion, a high return on investment

- Pay as the construction works proceed.

- Excellent for those looking for a second house or for investors

- Advantages of a Ready-Made Property

- Immediate money from rentals

- Construction is risk-free.

- Alternatives for immediate resale

- Appropriate for individuals that are looking for speedy returns

If you are looking to purchase a property for the purpose of generating rental income, it is recommended that you choose for a ready unit. If you want to achieve long-term appreciation, you should investigate off-plan options.

Your decision also depends on your goal while figuring out how to invest as an foreigner — either short-term rental income or long-term growth.

Opportunities for Non-Residents to Make Payments

Using the following methods, Dubai makes it simple to make payments remotely:

- Wire transfers from the bank

- On certain projects, cryptocurrency is being used.

- Credit and debit cards issued internationally

- Plans of payment for post-handover (for off-plan purchases)

It is important to determine whether the developer provides help for international buyers or specialist relationship managers.

Documents that you require

Generally speaking, as a non-resident, you will require the following:

- A duplicate of your passport

- A sales agreement that has been signed

- Proof of payment transfer

- Notarized Power of Attorney (if appropriate)

- No requirement for a visa or Emirates ID. No local address needed.

Before you commit, make sure to check this final checklist Verified agent or lawyer

- Real estate located in a freehold zone

- RERA registration taken by the developer

- Clearly defined payment schedule and escrow account

- The SPA was examined and signed.

- PoA completed (if it was necessary)

- A title deed was obtained.

Conclusion

In a word, yes. When compared to other locations around the world, Dubai makes it easier to purchase real estate remotely. You may invest with confidence without having to physically see the property if you have the necessary direction, legal protection, and certified developers. This is true whether you are investing for long-term gain, rental income, or lifestyle.

Real estate ownership from a remote location is not only feasible in today’s society, when everything is moving toward a virtual reality, but it is also possible.

FAQ (Frequently Asked Questions)

Yes. People who don’t live in Dubai can buy property in certain freehold places. The whole process can be done from afar with digital platforms, e-signatures, and registered power of attorney (POA) services.

Buyers usually need a copy of a legal passport, proof of address, and sometimes bank statements to show that they can afford the property. You can send these online or have them attested by the UAE embassy.

The buyer can sign the SPA online or name a registered power of attorney in Dubai to do it for them. For some deals, the Dubai Land Department (DLD) accepts e-signatures.

People who don’t live in the country can send money straight to the developer’s or escrow account through an international bank transfer. The DLD keeps an eye on escrow accounts to make sure that buyer payments are safe.

You can sign up online with the Dubai REST app or with the help of a valid Power of Attorney. As soon as the DLD processes the deal, the buyer gets the title deed online.

Join The Discussion