Table of Contents

Dubai’s real estate market is one of the strongest in the world. People are especially interested in the two new projects, Aurelia Residence in Dubai Sports City and Alta View Skyhomes in JVC. It’s likely that both projects in Object 1 will make money, but they will do so in very different ways. They will both go up in value, rent out, and stay stable in the long run.

Understanding Aurelia Residence Through Market Movement

Aurelia Residencedubai sports city apartments, a community known for stability, predictable rental yield, and long-term tenant appeal. Sports City has always been preferred by families and residents working in nearby business districts. While it is not the fastest-appreciating market in Dubai, it is one of the most reliable.

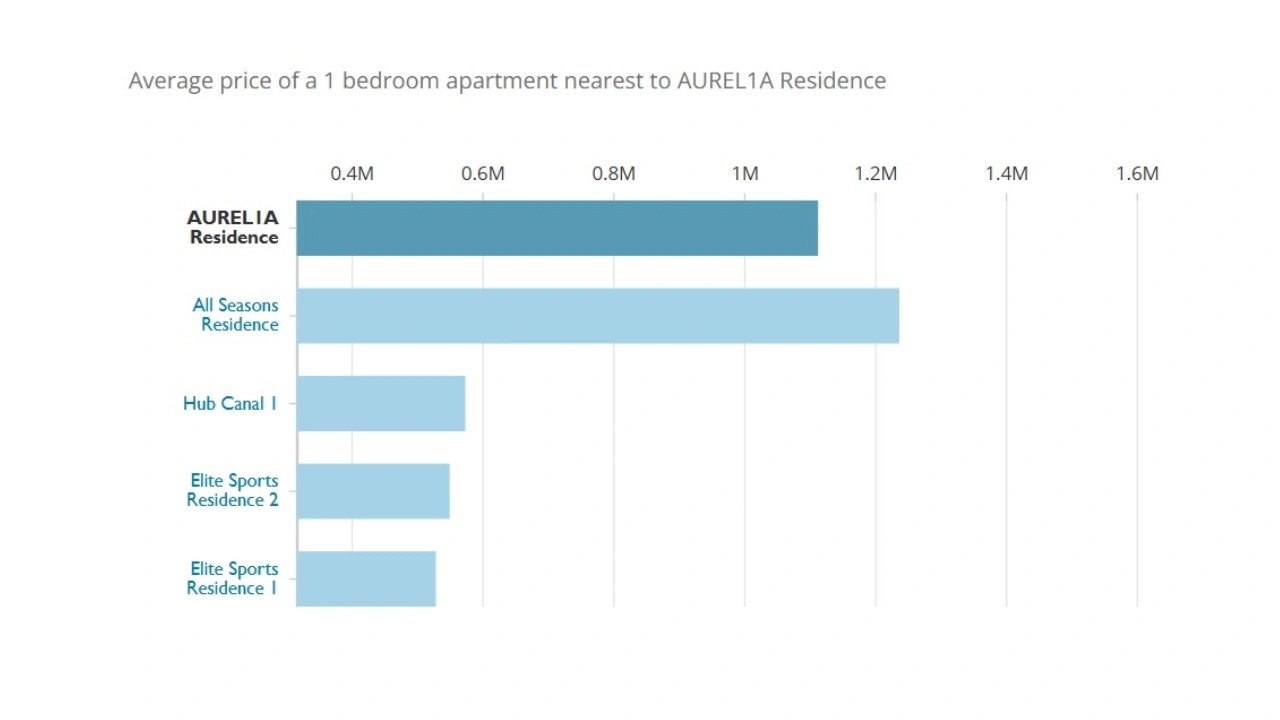

This graph shows how the prices of one-bedroom apartments in the neighborhood fluctuate over time. The price of residences

dubai sports city apartments is roughly 1.09 million AED, which is in the middle of the range. It’s not the cheapest or most costly place in the neighborhood. This stance was chosen on purpose, and it will be helpful for clients in the long run. High-end properties that aren’t too pricey have fewer vacancies and better yearly returns. This is because tenants are more inclined to prioritize quality and remain longer.

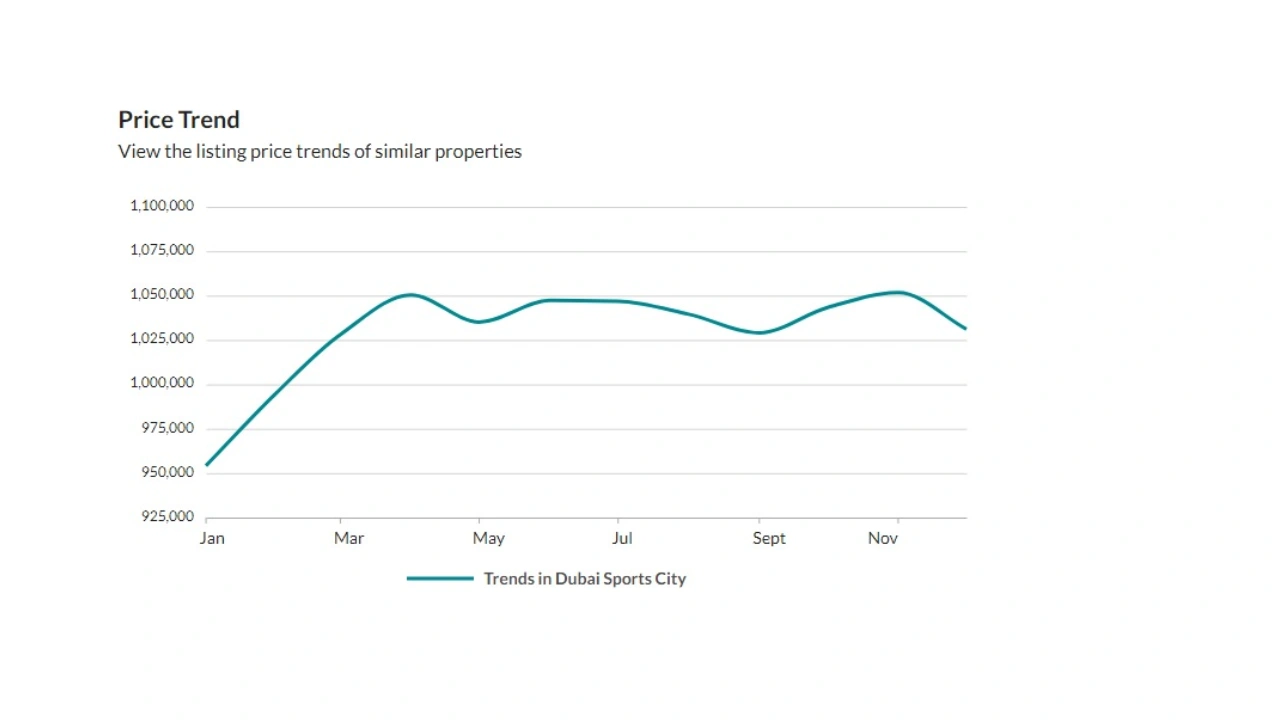

The next graph helps reveal the overall momentum of the area.

The trend is still going higher, going from 950k at the start of the year to little over 1.05M. There aren’t any big decreases or rises. This is what a low-volatility group does all the time. Sports City does not usually deliver explosive appreciation, but it rarely underperforms even during slow market conditions.

This stability is why Aurelia Residence appeals strongly to income-focused investors.

How Alta View Skyhomes Aligns With JVC’s High-Momentum Market

Alta View Skyhomes jvc apartments for sale , one of Dubai’s busiest and most transacted districts. JVC behaves completely differently from Sports City. It attracts younger residents, short-term rental guests, professionals, and investors hunting for quick appreciation.

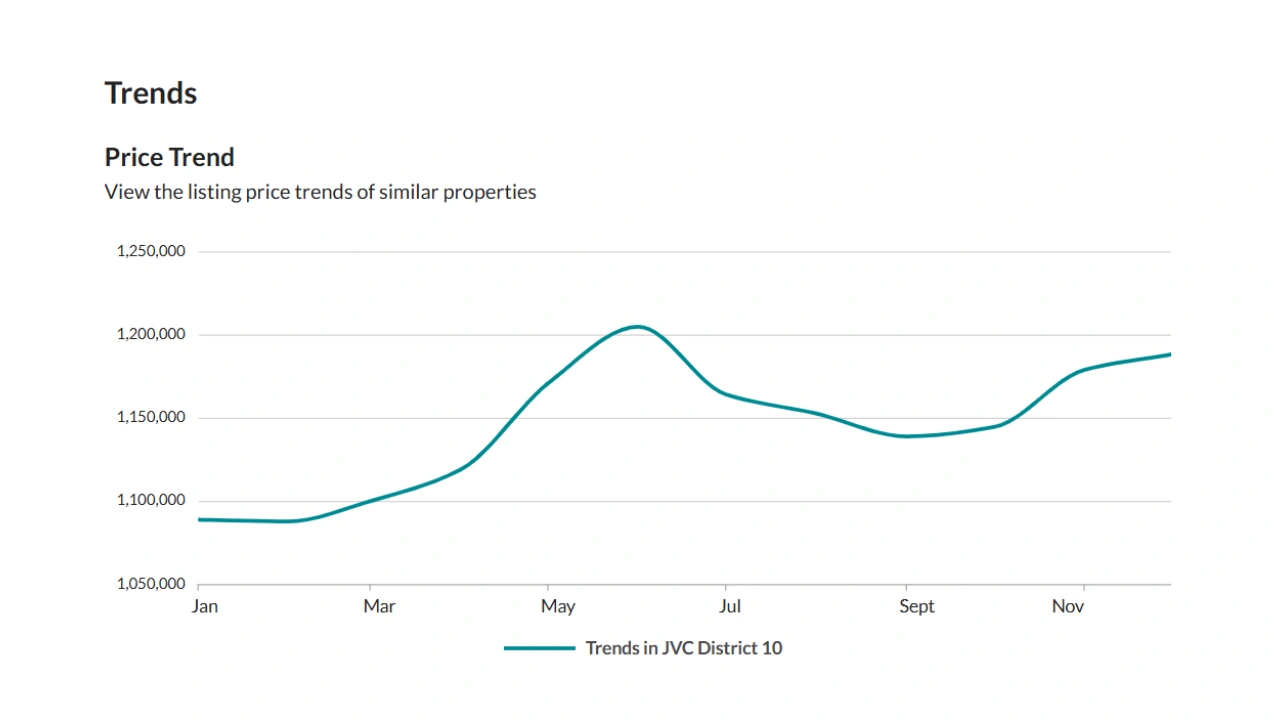

The trend shows movement, dips, rises, and strong pushes upward. Values start near 1.08M AED, rise to 1.2M AED mid-year, then bounce again. This kind of movement is typical in high-demand, high-transaction communities. Such behaviour usually indicates stronger resale potential and higher appreciation rates.

To understand Alta View’s jvc apartments for sale advantage even better, the district performance chart is essential.

The chart highlights how certain districts like 10 and 13 are hitting 1,500 AED per sq ft—well above JVC’s average of 1,300 AED. When premium districts outperform the average by a wide margin, the community’s overall price ceiling tends to rise. This means JVC has further room for appreciation, especially for premium high-rise developments like Alta View.

JVC is also one of Dubai’s top three districts for yearly property transactions. More transactions create more liquidity, which is always good for investors planning future resale.

A Few Key Differences Between Aurelia and Alta View

Below are only the three pointers you requested:

Appreciation Potential

Alta View: Higher appreciation due to JVC’s strong demand cycles and constant new launches.

Aurelia: Moderate appreciation based in Sports City’s stable, slower-moving market.

Rental Behaviour

Aurelia: Long-term tenants, lower vacancy, stable yearly income.

Alta View: Higher rental demand but more tenant turnover due to its younger audience.

Market Risk Level

Sports City: Low risk, steady movement.

JVC: Medium risk, high reward for investors targeting appreciation.

Return on Investment (ROI) Breakdown

Aurelia Residence

A typical one-bedroom dubai sports city apartments priced around 1.05M AED can generate annual rent near 80,000 AED. This results in a gross rental yield of 7.5%–8%.

Appreciation usually falls between 3%–5% per year.

When combining rental income and appreciation, Aurelia’s ROI averages 11%–12%.

This makes it ideal for investors who want predictable income rather than waiting for resale gains.

Alta View Skyhomes

A one-bedroom jvc apartments for sale priced around 1.2M AED in JVC usually rents for 90,000–100,000 AED yearly. This also results in a gross rental yield of 7.5%–8%.

Appreciation in JVC is higher, typically 6%–9% annually.

This creates a combined ROI of 14%–15%, ideal for momentum-focused investors.

Community Lifestyle and Tenant Profiles

Sports City offers more open views, wider roads, quieter surroundings, and larger apartment layouts. This explains why families and long-term residents prefer Aurelia. Tenants here tend to stay for years, making it easier for landlords to maintain consistent occupancy.

JVC offers a more urban feel with cafes, restaurants, co-working spaces, and shorter commutes. Alta View attracts a younger, professional crowd, along with short-term rental guests. This creates strong rental demand, but tenant turnover is more frequent.

This difference directly affects rental management style:

Aurelia = more predictable,

Alta View = more dynamic and active.

Investment Safety vs Investment Growth

Every investor falls somewhere on the spectrum between safety and growth.

Aurelia represents the safety side.

Alta View represents the growth side.

Investors who typically choose Aurelia Residence value:

- Predictable income

- Low vacancy

- Lower market risk

- Tenant stability

Investors who prefer Alta View Skyhomes prioritise:

- Resale earnings

- Quicker appreciation

- Strong liquidity

- Younger tenant base

Both options are strong — they simply serve different investment mindsets.

Need a More information About It?

Our agents will help you explore premium options tailored to your lifestyle, location preferences, and investment goals.

Which Project Is Better in 2025?

Aurelia Residence is better if your goal is dependable rental income with minimal volatility.

Sports City grows steadily every year without sharp movements. Families and long-term tenants ensure high occupancy and low management workload.

Alta View Skyhomes is better if your goal is appreciation and resale strength.

JVC’s upward price cycles, strong district performance, and higher price ceilings make Alta View ideal for 3–6 year resale strategies.

Final Summary

- Aurelia is the stable, predictable investment.

- Alta View is the faster, growth-oriented investment.

- Sports City grows steadily; JVC moves aggressively upward.

- Sports City attracts families; JVC attracts professionals.

- Sports City offers steady income; JVC offers stronger appreciation.

Your choice depends on whether you want consistent income or maximum growth.

Join The Discussion