Table of Contents

The Dubai real estate market has become a popular place for investors from all over the world. Off-plan properties are still the most popular choice for investors because they have low prices and a high potential for return on investment. But what keeps buyers safe in these kinds of deals before the property is even built? The Escrow Account in UAE is a crucial legal tool that protects buyer payments and helps keep trust in the off-plan real estate market.

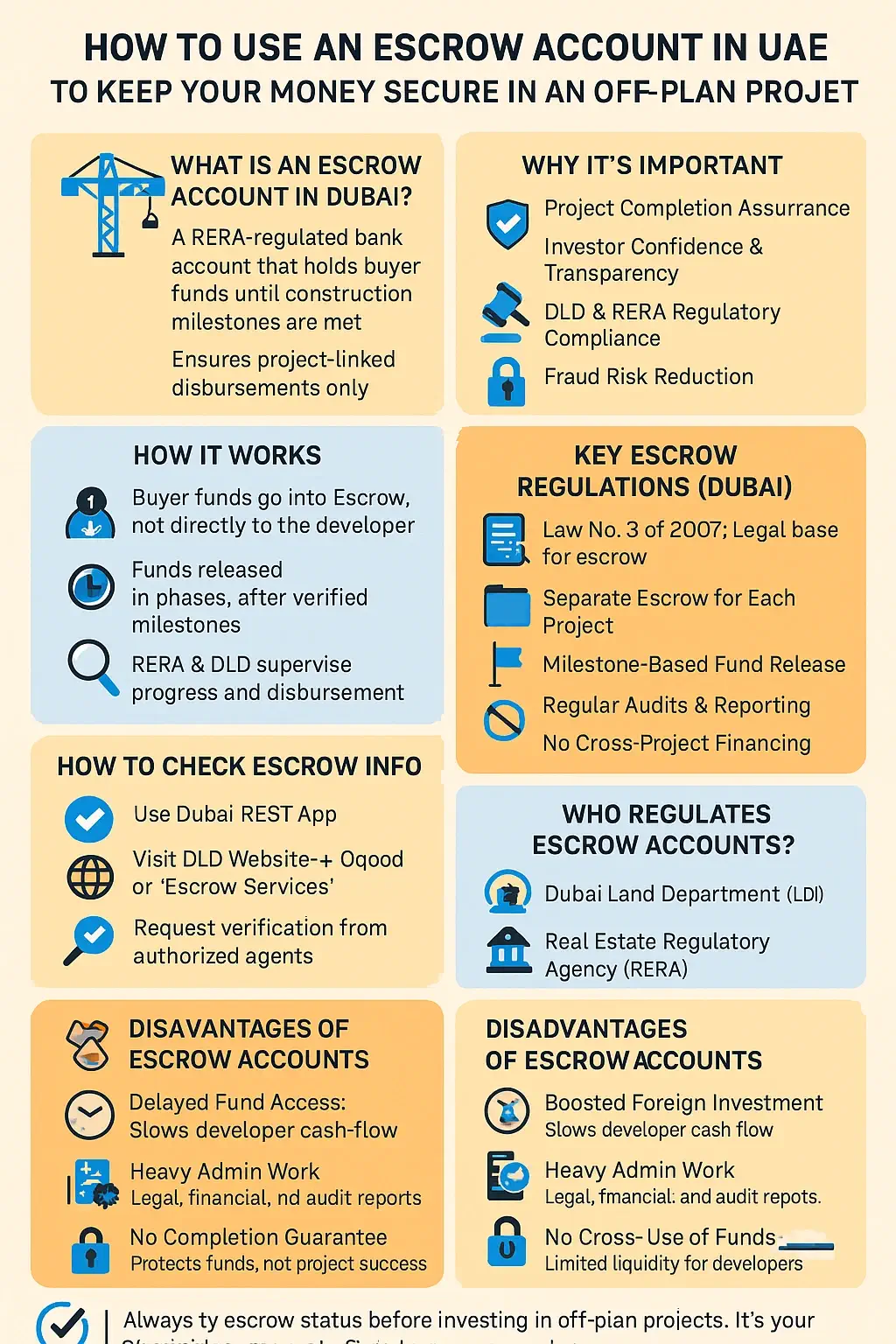

What is an Escrow Account in Dubai?

An escrow account is a bank account that is regulated and holds the buyer’s money safely until certain project milestones are reached. Escrow account is a neutral place to keep investor money when it comes to real estate, especially off-plan projects. Real Estate Regulatory Agency (RERA) keeps an eye on the account to make sure that developers can only get money when they can prove that construction is in progress.

How It Works:

For people in Dubai who buy a house before it’s built, the money doesn’t go straight to the builder. The money is put into an Escrow Account in UAE instead. The Real Estate Regulatory Agency (RERA) is in charge of this account. This account keeps the money safe and makes sure that the developer only gets it in stages and after meeting certain building goals.

The main goal of this method is to offer safety to buyers. It’s easy to understand and makes sure that their money is closely linked to how the building is going. If the developer doesn’t make deadlines or stops working on the project, RERA can step in and freeze the account. People who buy homes can be sure that their money is only being used for the project they invested in, and developers are more likely to be responsible with this method.

What is an Escrow Account used for?

If you want to invest in Dubai’s off-plan sector, you need to know what an escrow account is used for.

Main Uses:

- Project Completion Assurance: Stops developers from using money for other projects.

- Investor Confidence: Makes foreign investors more likely to invest by making sure things are clear.

- Regulatory Compliance: Makes sure the developer follows the rules set by DLD and RERA.

- Reducing the Risk of Fraud: The developer or anyone else can’t just take money out of the account.

- All approved off-plan projects in Dubai must now have escrow accounts, which are essential for the sector’s trustworthiness.

An Overview of Escrow Accounts in UAE

There is more than one trust account in UAE, but Dubai has the most rules. Dubai was one of the first cities in UAE to have strict escrow rules. This was because of Law No. 8 of 2007, which deals with Escrow Account in UAE for real estate developments.

Important Things to Know About Escrow in UAE:

The Dubai Land Department (DLD) says that before they can start selling, all off-plan projects must be registered with the government. As a result, each project in UAE needs its own Escrow Account. The developer must open this account at a bank that has been approved by the Real Estate Regulatory Agency (RERA). This keeps the buyer’s money separate and under close watch.

Keep in mind that the money in this escrow account can only be used for the job it was sent for in the first place. That means you can’t use it for any other work or projects. Builders need to send in project plans, financial feasibility studies, and other paperwork to open and keep the account open. RERA and DLD keep a close eye on these accounts and don’t let the money out until they’re sure that the building goals have been met.

The real estate market in Dubai is one of the safest in the area because people believe and are open with each other a lot. With its strict rules on escrow, the city has set a high bar for protecting buyers, especially those who buy homes before they are built. People who buy something can be sure that it will be well spent, and there is a better chance that it will be finished on time and well. This lowers the risk to their money.

Escrow Account Rules in Dubai

RERA strictly enforces the rules for escrow accounts in Dubai. During the global financial crisis, the region had problems like stalled projects and developers going bankrupt. These rules are meant to stop those kinds of things from happening again.

Main Rules and Requirements:

- Developer Registration: Developers need to sign up with RERA and have a history of being financially trustworthy.

- Separate Accounts: Every off-plan project needs its own Escrow Account in UAE.

- Milestone-Based Release: Developers can only get money after independent auditors check that construction milestones have been met.

- Auditing: The DLD needs regular audits and reports.

- No cross-financing: You can’t move money from one project to another or use it to pay for things that need to be done.

The Dubai Land Department (DLD) makes sure that these rules are followed. If you break them, you could get a fine, lose your licence, or even go to court.

How to Check Escrow Account in UAE?

Investors have the right and the duty to check that a project’s escrow setup is real. The DLD has made this process clear and easy, which is a good thing.

How to Look Up Your Escrow Account Information:

In Dubai, you can use the Dubai REST App or go to the DLD’s website and look for “Oqood” or “Escrow Services” to see information about your escrow account. You can also ask a trustworthy provider for more information. These steps will help make sure that your payments are safe and follow RERA rules.

How to Open an Escrow Account in UAE

It is a legal facet for developers to know how to open an Escrow Account in UAE. Only developers who are registered with DLD can start this process. Steps are mentioned below-

- you need DLD and RERA project approvals.

- Business licence and trade papers.

- Study of the project’s feasibility and cost breakdown.

- Proof of ownership of land

- The first investment will be put into your escrow account.

- You can get an agreement with a bank that is RERA-accredited, like Emirates NBD, Mashreq, or ADCB.

The DLD lists the escrow account and makes it searchable by the public once it is active. This gives investors peace of mind.

Escrow Account Regulations In Dubai

Dubai’s rules about escrow accounts are some of the strongest in the world of real estate. These regulations are governed by-

- Law No. 8 of 2007: Sets the legal basis for escrow accounts.

- RERA bylaws set rules for how things work, how to report problems, and how to make sure everyone follows the rules.

- RERA Circulars: Regular updates that show how the market is changing.

These bodies are regulated by the following departments

- The Dubai Land Department (DLD)

- The Real Estate Regulatory Agency (RERA)

These rules make sure that every off-plan project that starts in Dubai has a clear, fair, and well-audited process.

Disadvantages of Escrow Account in Dubai

1. Delays in receiving funds

One big issue with trust accounts is that builders can’t get the money from buyers right away. The money isn’t given out until reports show that certain building goals have been met. Small businesses that don’t have a lot of cash on hand may find it hard to keep up with their cash flow during this process. The company might not be able to keep building if they can’t get the money they need while they wait for approval. This delay helps buyers, but it costs developers more money and can slow down projects, especially when other things happen that affect the building schedules.

2. Administration Cost

It takes a lot of paper work to keep a trust account up to date. For example, they have to do regular financial checks, report on the progress of the building, and make legal disclosures. When there is this much paperwork, you need different teams for rules, law, and finances. This much work can be hard for new or medium-sized workers. There is a lot of paperwork and checks to make sure everyone is following the rules, which may slow down projects or take away resources that could be used for building or marketing.

3. Lack of Promise of Completion

Escrow funds lower the risk, but they don’t promise that the job will be done. Bad economic times, global crises, problems in the supply chain, or sudden changes in government policy are just some of the things that can cause projects to fail, even if they are well run. The buyer’s money is safe, but shipping plans or projects may be put on hold. With the escrow plan, the risk is cut down, but it’s not gone totally. However, it’s not 100% certain that it will keep your money safe, especially when the market is unstable.

4. Lack of financial freedom

It is against the rules for workers to use the same money for more than one job, even if they work for the same company. One project’s extra money can’t be used to help another project that is having trouble because each project has its own trust account. But it’s harder for writers to keep track of their general cash flow. This makes things clear and stops people from misusing money. At times when markets are uncertain, this limit can be very tough because builders don’t know how to spend their money in the best way. But even so, the system’s attention on project-specific accountability is very good for investors.

How Escrow Accounts Affect Dubai's Real Estate Market

Escrow accounts have changed the Dubai real estate market a lot since they were first used. Before 2007, the off-plan market was riskier because developers didn’t have to keep their funds separate.

Positive Results:

- More Foreign Investment: International buyers are more likely to invest in Dubai.

- Less Fraud: People are using buyer funds less often.

- Improved Project Completion Rates: More projects are now finished than they were in the early 2000s.

- Developer Responsibility: Even big developers now have to follow strict rules.

DLD says that between 2021 and 2024, escrow accounts helped protect more than AED 70 billion worth of off-plan transactions.

Winding Up

Buyers need escrow accounts to be safe in Dubai’s real estate market, which is always changing, especially when they buy homes that aren’t built yet. This will help you make safe and smart decisions.

In Dubai, the system is designed to protect investors. For example, the DLD app lets you check the data in a trust account. There are some issues with trust account systems, but the pros are much greater than the cons, especially when a lot of money is at stake in a real estate deal.

Even if you’ve bought real estate before, make sure that your next off-plan investment in Dubai is kept safe in an Escrow Account in UAE that has been approved by RERA. It’s more than just a box to check; it’s your money safety net

FAQ (Frequently Asked Questions)

An escrow account is a safe, government-regulated bank account where payments from people who buy homes before they are built are held until the developer meets certain building milestones. This makes sure that the money is only used for the accepted project, which keeps buyers safe from fraud or delays.

You can use the Dubai REST app or the website of the Dubai Land Department (DLD) to make sure of this. You can search for the escrow account by developer or project name to see if it is listed and follows the rules.

Yes. Law No. 8 of 2007 says that all developers in Dubai who sell off-plan homes must open an escrow account that is allowed by the DLD. It’s against the law to take payments from places other than this account, which protects both the buyer and the seller.

Join The Discussion